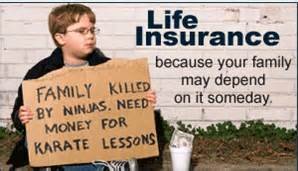

If you’re looking for quotes for life insurance and not planning on reading what I have posted then just enter your information on the side and they’ll be displayed on the next screen.

Among the important aspects to take into account is what sorts of lifestyle you would like your household to own when you pass away. Exactly how much financial impact will your death cause to your family? Are you wanting them to become filthy rich when you die? Would you like your partner to keep to focus? Would you like them to become debt free? Can it be important that they keep carefully the same house? Will they be fine without having any insurance?

The total amount of insurance you might need/want will change widely depending on your overall financial situation. Why don’t we take a look at two general situations.

Situation one: you desire enough insurance to pay for a particular use and don’t need any insurance to give you future income for your spouse.

This could be the specific situation where both spouses are working and making decent money and in addition have no kids. In that case, they might decide to get enough insurance to repay all debts, of which point the survivor should always be fine given that they’ll keep working.

This calculation is pretty easy. Just add the amounts of debts and whatever other costs you would like covered, and that is just how much insurance you’ll need. The situation, of course, is that the amount of debt you have got now together with level of debt you’ve got in 10 years will undoubtedly be quite different. (Hopefully, you’ll owe less in 10 years!)

There isn’t a lot you can certainly do concerning this other than buy different terms of insurance. For example, you could buy $100,000 for ten years and $100,000 for two decades. You could also cancel insurance whenever you want, so one method would be to insure for the whole amount necessary and, when you wind up debt-free, then just cancel the insurance. Life insurance policies needs are extremely inexact so sometimes you just need to pick an acceptable amount and go with it.

But I have life insurance through work…

Nice one! You still need coverage which will follow you wherever you work. Whenever you leave your present job, you won’t be insured along with your family won’t be protected. When you wait until you leave your task to find insurance coverage, you’ll probably end up paying more because you’ll be older. Plus, employer-paid policies usually don’t replace as much lost income as people absolutely need.

But I’m a stay-at-home parent…

Just because you’re not generating income does not mean you’re not generating value when it comes to family—value that could need to be replaced if you weren’t around. If something happened for your requirements, imagine the price of hiring caregivers for attending the requirements of your kids. Your partner will have to hire you to definitely do everything you need to do now, from childcare to cooking and shopping. That does not come cheap, so be sure you don’t undervalue your contribution to the family by skipping life insurance coverage.

But I work out and eat lots of kale…

Awesome—you’re immortal! Oh wait, you’re not. Death comes to all or any of us, even to the svelte and vegan. We’re not saying you really need to stop looking after yourself, exactly that you really need to think about having term life insurance among the ways you care for yourself. It’s usually the most health-conscious folks who are the most reluctant to look for life insurance, despite the fact that they could be eligible for reduced premiums as an incentive with their healthy lifestyle. Make use of the lower term life insurance cost available to you by virtue of the exemplary exercise and diet habits.

The quantity of life insurance policies you’ll need to purchase varies according to your particular life situation. However, there are lots of basic guidelines it’s possible to follow.

“There are many rules of thumb regarding just how much life insurance policies will do,” Whiteman said. “Ultimately, it’s a personal decision that’s predicated on a range of factors including your debts, mortgage, potential college costs for your young ones (that’s when you yourself have any), and likely burial expenses. Bankrate has a good life insurance calculator that will help you come up utilizing the right amount.”

Bankrate says just how much life insurance you purchase can also be determined by factors such as your age, the ages of one’s spouse and children, and your income. Know that your premium rate will rise as you age. Term life insurance, which takes care of a particular number of years, will be the easiest way to control risk and keep future alternatives for life insurance coverage available. It’s important to take into account the ages of your spouse and kids as this can assist you with deciding what number of several years of income replacement should be necessary whenever you pass away.

Life insurance policies can fill a wide variety of needs, including within the finite several years of home financing and protecting the interests of a special-needs child that will need financial support after you’re gone.

In reality, 63% of Americans consider life insurance policies a necessity, based on the nonprofit industry group Life Happens. But 30% say they don’t have enough coverage, 19% only have group life insurance coverage (the coverage that’s available through work and often does not provide enough money to generally meet a family’s needs), and 43% have none after all, based on Life Happens and industry group LIMRA.

While determining your current financial needs, you additionally want to consider your future needs. Perhaps you’re still paying off your mortgage or you’re funding your child’s college tuition or perhaps you’re retired and also have enough savings to last you the following three decades. Account fully for your future spending needs. While you may have immediate obligations, don’t forget to consider your future obligations.

Ultimately, your lifetime insurance should cover both the immediate and future needs of the family. Make sure you get enough term life insurance to protect your family. The professionals at Phocus Insurance can find you the best policies for your needs. Situated in Phoenix, Arizona we serve all your valuable personal and commercial insurance needs

One factor used by insurance vendors when determining your insurance needs and rates is just how long you could be anticipated to live. If you are young, healthy, and live relatively without risk then there is little want to element in the life span expectancy when you purchase life insurance. However, while you age or have health conditions, then you may desire to calculate your life expectancy before buying insurance. Although no one can predict precisely how long any one person will live, for a long time actuaries and statisticians have been tracking average life span and the factors that tend to increase or decrease that expectancy.

Probably the most key elements that influence life expectancy are beyond our control. For example, sex and genetic make-up are foundational to factors in predicting longevity. Other factors that influence life expectancy are within our ability to change. Whether or otherwise not we smoke, what and exactly how much we eat, how much we exercise, when we engage in certain sports (such as mountain climbing, scuba) and activities (piloting private aircraft), driving habits, the extent to which we use drugs and alcohol, are all factors that may influence life expectancy.