Life Insurance for Smokers

Obtaining Life Insurance for Smokers

I understand that some people simply love to smoke. I do have very competitive rates for smokers as I work with over 60 Carriers.

Tobacco users can get all of the various life insurance products: Term and Whole Life insurance as well as No Medical Exam and Burial insurance plans.

Although I do recommend speaking with me first , I understand people simply want to get a ballpark estimate of a life insurance policy. You can run your own term life insurance policy by following this link: (Note: This is for full medically underwritten Policies only. ) Term Life Insurance quote

Lets Compare Life Insurance Rates for Smokers and non Smokers

As you are probably aware there is going to be a significant rate difference between smokers and Non smokers. I wanted have provided sample rates of no medical exam and full medically underwritten life insurance plans.

1. Term Life Insurance Quotes

In our example I will use a Male, 40 years old, California resident, No health impairments. $250,000 face amount, 20 year Term Life Plan

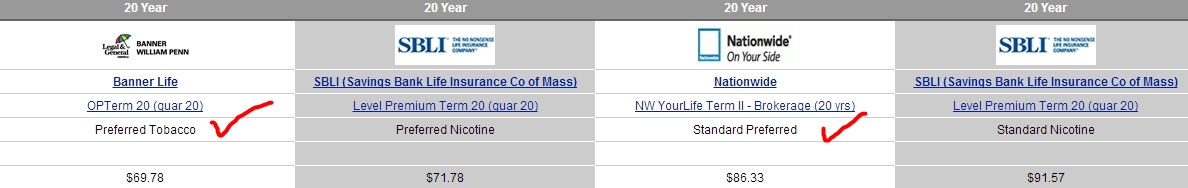

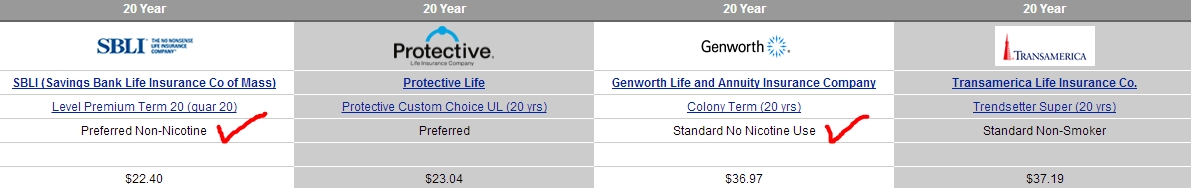

Smoker Rates for a Full Medical Exam Plan ( Paramed exam)

Non Smoker Rates for a Full Medical Exam Plan ( Paramed Exam)

As you can see, smokers can pay 3X as much as non smoker pays. I put the above example in as most people think smokers only pay 20 0r 30 percent more, not so as you can plainly see from my sample quote

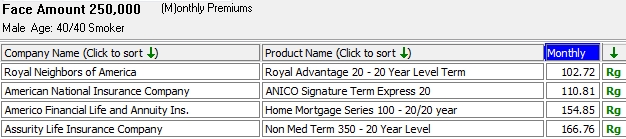

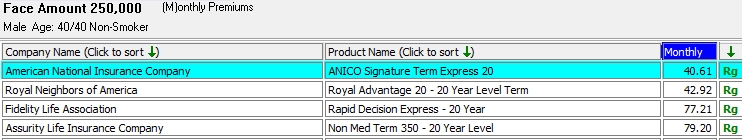

2. No Medical Exam Life Insurance rates, same demographics.

NOTE: I am quoting a Standard health class rating , for both, to keep things on an even field. Some no medical exam plans will offer a preferred rate for Non Smokers.

If I quit smoking, then what can I expect for life insurance coverage?

Many life insurance companies will classify you as a non-smoker and charge you the lower insurance rates after you have stopped all nicotine based product use for at least one year. This means no Nicotine products whatsoever i.e. nicotine gum , e-cigs ( some do have Nicotine) or patches.

I purchased Life insurance as a smoker , but I have quite smoking, what can you do for me?

I have carriers that will offer very good rates for those that have no tobacco / nicotne use for at least 12 months. If you have a Term Life Policy in place now and they have you listed as a smoker, and you have quite smoking for at least 12 months then we need to do a Life Insurance Policy review. You can compare rates for Smokers and No Smokers by following these links:

Compare No Medical Exam rates for smokers and non smokers by clicking HERE

Contact me today for a free no obligation , no hassle quote. Or , fill out our Contact request form. My number is 512-963-5000.