GEICO Term Life Insurance Quotes Review

GEICO Term Life Insurance Quotes Review

What you may or may not realize about their Term Life Insurance Quotes

If you’re looking for quotes for GEICO life insurance and not planning on reading what I have posted then just enter your information on the side and they’ll be displayed on the next screen.

Now, first things first, I like GEICO for car insurance. As a matter of fact, I have my car insured through them.

GEICO payment reminder.

The next payment on your auto policy is scheduled for 06/01/2016. On that date, we will charge $83.65 to your VISA card.

Need to review your payment? GEICO Mobile makes it easy. With the swipe of a finger you can view your billing statements, update your account information, and much more.

Don’t forget — any changes you make to your policy, such as adding a vehicle or removing a driver, may impact the amount of your automatic payment.

Thank you for using GEICO’s recurring card payment option.

Sincerely,

Your GEICO Service Team

And I think their commercials are pretty funny. But, like Wells Fargo Banks’ Life Insurance product, I think the consumer needs to be aware of a couple of things and that is why I am writing this article about GEICO Term Life Insurance Quotes Review:

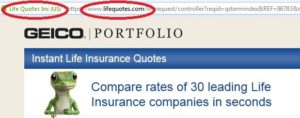

1. GEICO Term Life Insurance Quotes are actually through Life Quotes Inc. I think this is one of those “Partnership” deals were GEICO provides their good name and consumers see the trusted GEICO name and move forward with a quote. I suppose there’s nothing wrong with this, but you have to look around to see the full disclosure ( It is at the bottom of the page although there is a link and a mention about Life Quotes Inc within the second paragraph): Here is the disclosure that is located on the bottom of the Page:

If you choose to get a rate quote online, you will be taken to the Life Quotes, Inc. website that is not owned by GEICO. Any information that you provide directly to Life Quotes, Inc. on its website is subject to the privacy policy posted on their website, which you should read before proceeding. GEICO assumes no responsibility for their privacy practices or your use of their website.

Life coverages are written through non-affiliated insurance companies and are secured through the GEICO Insurance Agency, Inc.

2. Once you choose a plan, you can then apply. After you click the application link, you will then spend time reading all about the plan and it will be up to you to figure out if you qualify for this plan. What if you don’t qualify? What do you do, choose another plan? Seems like a waste of time. On top of all this, you are STILL going to have to speak with one of their agents! Why not just call, explain what you need, your health etc. They are squarely after those who do not, initially, want to speak to an agent. But you will end up speaking to someone regardless. It almost seems like they anticipate you doing all this work and being 100% committed to the process.

Now, on the positive side:

I ran a quote through Life Quotes and they do seem to work with most of the Major Carriers. Also, with these carriers, I am sure they can handle those with health issues. They also display a variety of life insurance coverage options which is also helpful.

Summary

Getting a good life insurance policy, especially if you have any type of health impairment, requires speaking to a life insurance agent. I use over 60+ Carriers and can handle a variety of health impairments.

One important note at the outset is that m2insurance.com represents all the exact same companies that GEICO Life represents. However, we also represent about 50 more companies, aside from the companies listed for Geico Life Insurance.Therefore, if you are searching for GEICO life insurance coverage quotes, remember to also view the quotes you can expect to ensure that you are getting the lowest whole and term life rates.

Having said that, know that it’s difficult to give a truly honest overview of GEICO life insurance policies due to the fact, from the one hand, GEICO Insurance is a great company that is in business since 1936 and is now the next largest private passenger auto insurance company in the nation with assets exceeding 28 billion dollars.

So of course, in the event you wreck you car, GEICO Insurance certainly has got the methods to take care of it… But precisely what does any of this have to do with life insurance?

Practically Nothing! In fact, because you can have read various other GEICO life insurance reviews, GEICO does not offer life insurance after all. Instead, GEICO insurance uses its incredibly successful marketing machine A.K.A., “Martin the Gecko” to generate leads for life insurance which it then shares with another company called Life Quotes.

Which means when you purchase term life insurance from GEICO, you’re actually buying life insurance coverage from a third party vendor named Life Quotes, who GEICO has chosen to provide its term life insurance “leads” to!

That which we were able to discover by doing a bit of research on Life Quotes was that Life Quotes was founded in 1984 and over the past three decades they’ve been in a position to achieve a large amount of success having insured over 300,000 individuals!

In addition, it appears to be like they represent most, if not all, of the top life insurance carriers which means Life Quotes will be able to place just about anyone who qualifies with a quality life insurance policies company.

Why would the next largest automobile insurance company, GEICO Insurance, elect to “outsource” its life insurance policies leads to 3rd party vendor?

All things considered, you would assume that GEICO insurance carrier has the agents, the call centers, therefore the customer care representatives needed to take on such a project.

So just why wouldn’t GEICO only want to begin selling life insurance policies themselves?

Selling term life insurance will be a lot different than selling auto insurance. After all, it is much easier to determine the value and condition of a car or truck, motorcycle, or boat than it is to determine the worth of a family member.

See, to be honest, when it comes to selling term life insurance, quoting someone accurately and knowing which insurance company you need to apply with could become really, really complicated.

Add much more difficult cases such as for instance using life insurance coverage for estate planning, such as for instance funding an irrevocable life insurance policies trust, or buy sell agreement, and you begin to get the idea why you might want to look elsewhere in terms of getting protected.

So that you chose to look for term life insurance quotes online and one of the top search engine results you notice is Geico! Needless to say this would be a delightful idea since Geico is a tremendously reputable and well known insurance provider. They have a solid “A” rating by A.M. Best and have been offering plans direct to consumer since 1936. I love Geico for their great customer service and fast claims processing occasions when it comes down to auto or home coverage. However i will be here to share with you that Geico doesn’t actually offer life insurance coverage to consumers.

I might want to save 15% or more in fifteen minutes on life insurance coverage but I can’t, not with Geico at least since they don’t offer their very own life insurance policies product. Instead they teamed up with Life Quotes Inc. that is a nationwide call center that brokers life insurance coverage plans for many big carriers. Therefore if you submit your information to Geico to receive a quote, you should be expecting to receive a few calls from a Life Quote call center agent. I as a consumer myself hate when I am being tricked or mislead by a reputable company.

I am not sure how Life Quotes operates exactly but if they truly are like most other life insurance coverage call center out there, here are some thing you can expect. You will be bombarded with calls that have a stronger give attention to obtaining the sale and never centering on what’s most effective for you along with your family. Almost all of the agents working in these call centers are trained in selling techniques in the place of determining the best number of coverage to get or recognize the business to apply for centered on your preferences.

Term life insurance rates are fixed because of the law however the premiums are strongly affected by your general health. Make certain that you are upfront about any medical conditions or background history which means that your agent can quote you accurately. Once you find the best quote ensure you do a little homework by checking facts about the organization like how long they been with us, their financial rating and exactly what are their current customers are saying. This way it’s possible to sleep great at night knowing the company is supposed to be there to pay for your family in the case of the unexpected.

Once you get the best quote ensure you do a little homework by checking information about the organization like how long they been around, their financial rating and what exactly are their current customers are saying. This way it is possible to sleep great at night knowing the company may be there to cover your loved ones when it comes to the unexpected.

Well the good thing is that you can get all this done without difficulty by using the services of us. We make use of term life insurance companies such as MetLife, Prudential, Fidelity, Protective and TransAmerica just to name a few. We will use our 60 top life insurance policies companies to compare the whole marketplace and allow the best company earn your business. If you would like to get instant life insurance quotes click here to check out who is providing you with the most effective rates. For those who have a medical condition or a high risk occupation i would recommend you talk to certainly one of our agents directly. For almost any other questions go ahead and drop a comment below or just contact us.

This really is likely truly the only time you’ll hear me tell you that you should go shopping. When it comes to term life, it truly pays to search every several years – especially while you are younger than 50. It’s likely that you’ll have the ability to substitute your old term coverage with better coverage for lower premiums. At the least that has been my experience. Why?

People keep living longer. This occurs considering that the doctors and drug companies work miracles to expand our lifespan. So we’re all going to reside a lot longer than we think we have been. This means we’re going to be around considerably longer to pay those insurance fees, in addition to insurance vendors realize that.

In addition means lots of us are likely to die AFTER the policy expires. That translates into bigger profits for insurance providers. Because of this, it’s cheaper when it comes to insurance vendors to provide insurance and they’ve reduced the rates to be more competitive. When you haven’t gotten a quote for a lifetime insurance in the last 5 years, you borrowed from it to you to ultimately get a quote today. I saved a pile of dough…why should not you?

I’m sure i simply finished stating that I saved money when I got older, but I don’t want you to misinterpret that. If you need life insurance policies, you need to get it now. Today. This minute. Why? One major reason. You do not have guarantee there is a “tomorrow” with your name on it.

Nobody knows when their time is up. If you’ve read my story, you know I’m a big believer in taking your responsibilities seriously. If people be determined by you – like a spouse or children – be careful of these. I lived through a situation where people I depended on really didn’t do what they must have. Because of this, my siblings and I struggled for years.

In the event that you lie about your health insurance and hobbies on your own insurance application and then die, your loved ones isn’t likely to have the death benefit you paid for. In the event that insurance provider proves which you completed the insurance coverage application falsely, they’ll just refund the premium you paid to your beneficiary. That’s a bummer.

Be honest (but stop doing things that allow you to be a negative risk when it comes to insurance providers).

OK…I’m sure that in the event that you have a life insurance policies agent you really trust, nothing I say is going to help you to buy term insurance from somebody else. But that shouldn’t stop you from doing your research for any policy. Remember, buy term only (unless you have got estate planning needs) and keep everyone honest through getting a couple of quotes. Then when your brother-in-law rolls out the new policy he’s got at heart, you’ll be a lot more convinced he’s trustworthy. Win-win.

What money-savings tips have you come up with when it comes to getting term life insurance?

GEICO, which stands for Government Employees Insurance Company, founded in 1936 to sell insurance products to federal employees and certain people in the military. The organization went through many transitions within the next few decades, aided by the largest coming in 1996 when they were bought by Warren Buffett and his company, Berkshire Hathaway.

GEICO may be the company’s direct-to-consumer insurance that focuses mainly on auto insurance, nonetheless it has an extensive portfolio of coverage options such as for instance home, renters and motorcycles.

Direct-to-consumer implies that the main sales channel GEICO does not involve an intermediary, also referred to as agents.

Customers could possibly get a quote, buy a policy and work out changes to existing coverage by phone or directly online. There is a representative licensed to market products GEICO, but the majority of the sales policy carried out directly between GEICO and their customers.

Company direct-to-consumer insurance (such as for example GEICO, Esurance and Progressive) has an aggressive advantage over peers traditional agent-driven over them in that they’re able to keep costs down as they do not pay a big commission for every single sale and renewal. The downside is a customer with a tremendously broad insurance needs may unknowingly find themselves with gaps in coverage, unless they have a good understanding of exactly what they want.

Thanks to clever advertising campaigns and an adorable gecko, everyone loves GEICO. Even i need to agree totally that they’ve been a business leader. I shall also say that GEICO lives up to their claims, a minimum of with regards to car insurance. Unfortunately, exactly the same can’t be said about term-life insurance from GEICO

GEICO Doesn’t Genuinely Have Life Insurance Products?

GEICO isn’t the life insurance provider that they pretend to be on their website. In fact, the term-life insurance quotes that you will get from GEICO are now actually done through their partnership with Life Quotes Inc.

Life Quotes Inc is simply a term life insurance broker. Once you call them you will end up talking to a call center, and not getting the personalized attention you would from a completely independent term life insurance agency, like Chooseterm.com.

Whenever you request an online rate quote on GEICO’s website, it will probably mention that you’re planning to be studied into the Life Quotes Inc. website, that is not owned or operated by GEICO. In addition it specifies that GEICO assumes no responsibility for Life Quotes Inc.’s practices and therefore the coverage you may receive is not supplied by an insurance company this is certainly affiliated with GEICO. All this crucial information is covered in a disclosure statement at the end of this webpage.

Be Suspicious of This Particular Activity.

Life Quotes Inc. has partnered with GEICO, so they can use their good name and marketing genius to lure customers into requesting a quote from their website. GEICO has a reputation if you are the greatest deal available on motor insurance, so people assume the term-life insurance charges they’ve been given from GEICO will also be the greatest deal available.

Unfortunately, The Rates Are Not from GEICO!

This variety of misleading online marketing strategy should make you apprehensive, to put it mildly, especially since GEICO makes a point of disassociating themselves with Life Quotes Inc. inside their disclosure statement. They don’t feel at ease enough connecting their reputation to Life Quotes Inc. and I’m sure they spent time researching that decision. This is certainly a truly bad sign.

The Rates Are Not As Good As GEICO Claims

Another reason that you ought ton’t insure your daily life with GEICO is the high rates for anybody that doesn’t have perfect health. Just about ten-percent for the American population will qualify for their Preferred Plus rates, that are the rates which they advertise all around the site. The other 90% are almost guaranteed to get a lower quote through an unbiased insurance broker that knows simple tips to match you with all the right term life insurance company.

Don’t Count On Just One Single Quote.

Everyone should request multiple term-life quotes from multiple carriers prior to making a consignment, particularly if they usually have any health concerns. You can trust the brand that GEICO built with auto insurance, but you definitely shouldn’t trust all of them with your life. Term-life insurance is intended to give you peace of mind and you won’t get that from an organization that pretends to be something they’re not. Comparison shopping is the only way to acquire the financial security for your needs which they deserve, at a high price you can afford.

GEICO offers consumers individual term life insurance policies. Terms are available in five-year increments and policy values are normally taken for $10,000 to $25 million. GEICO term life insurance covers virtually any death, no matter the main cause, time or place. The only real exception is suicide inside the first two years.

Term life quotes for GEICO insurance are available online, at a GEICO insurance agency or by calling the business directly.

GEICO is just one of the strongest and a lot of recognizable insurance vendors in america. They usually have a strong corporate backing and high ratings from third-party ratings agencies.

Get insurance now if somebody depends on you. Don’t make me come over there…OK?

Life insurance policies provide beneficiaries with lump-sum payments when the insured party passes away or after a specific period of time has passed. Life insurance provides financial security by replacing lost income and covering expenses.

If you’re looking for a life insurance policy, we’ve got you covered. Through GEICO Insurance Agency, Inc., Life Quotes, Inc. offers affordable life insurance options to meet your family’s needs. Get a life insurance quote online or call us at 512-963-5000 to get the assurance of knowing your loved ones will be protected.

Life insurance helps you plan ahead and provide long-term financial security for your family when they would need it most. You can’t put a dollar amount on your loved ones, but a term life insurance policy can help ensure their future is protected. Determine how much coverage you need and how long it’s needed, and the GEICO Insurance Agency, Inc. and Life Quotes, Inc. can provide an affordable life insurance policy that is the perfect fit for you and your family. Get a life insurance quote online or call us at 512-963-5000 and get the satisfaction of knowing your loved ones are protected.

The easiest life insurance to understand (and the lowest cost to buy) is term life insurance which is why GEICO chose to offer it through Life Quotes, Inc.

Term life insurance provides straightforward death benefit protection without any expensive “cash value” or investment component add-ons.

Your term life insurance policy will offer level premiums for your choice of 10, 15, 25 or 30 years during which the premiums are guaranteed not to increase. As long as you pay your premiums on time, the company cannot cancel you. If the insured dies during the term, the death benefits are paid to the beneficiary without any complicated process or rules.

It doesn’t get any easier than a term life insurance policy, plus it’s the most affordable type of life insurance.

Term life insurance has become very popular with consumers in recent years because premiums for new policyholders have dropped to all-time lows.

Most companies allow you to pay on a monthly, quarterly, semi-annual or annual basis, so whether you’re a pay-all-at-once kind of person or you enjoy spreading it out each month, payment flexibility definitely makes term life insurance even easier to afford.

Your life changes constantly, right? From purchasing a new home to getting married or having children to starting a business or even retiring, your life and your financial situation are constantly in flux.

Because the financial needs of your loved ones change over time, you should take a look at your life insurance policy periodically.

The GEICO Insurance Agency suggests you review your life insurance coverage at least once every five years or when you experience a major life event such as change of income or assets, marriage, divorce, retirement, the birth or adoption of a child, or purchase of a major item such as a house or business.

GEICO Term Life Insurance Quotes Review

Medical Marijuana life Insurance

Life Insurance For Single Moms

Does Mental Health Affect Your Life Insurance

What You Need to Know About Buying Life Insurance for Someone Else

Military Spouse Life Insurance

No Medical Exam Life Insurance For Smokers

Rheumatoid Arthritis Life Insurance

How do I locate my father’s life insurance policy?

What Medical Exams Test For When Applying for Life Insurance?

Best Life Insurance Rates by Age

Do I have enough Life Insurance?

Will Life Insurance Pay For Suicide?

Do you have to have life insurance to get a mortgage?